Bankruptcy v. “Debt Management”

Is it better to file for bankruptcy or use a debt management company? It depends, as almost all things in the law do.

Bankruptcy certainly gives you more control, and it is much easier to get the creditors to conform. On the other hand, avoiding bankruptcy by using a debt management company has its advantages, too. Which should you go with? This is the age-old question we bankruptcy attorneys get (at least since the advent of the debt management company as an option). Today, I’ll speak about this decision a little bit. Listen up!

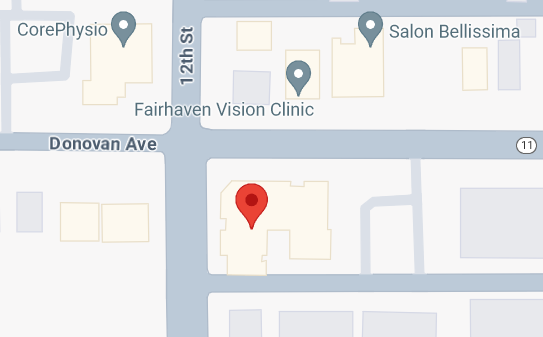

However, this is usually a very personal decision so I certainly can’t give you the definitive answer in a few minutes. But, you are on the right track by looking into this important decision and I encourage you to do more and actually seek out a Mount Vernon bankruptcy lawyer so you can ask questions.

I receive this question all the time, and it is usually those who are paying a pretty hefty payment every month that finally seek out my advice. Most of the time, these folks opt to change direction and look into a Chapter 7 or a Chapter 13 Bankruptcy. If you qualify for a Chapter 7, then it is usually a pretty easy decision to opt into bankruptcy rather than endure years of payments to a debt management company. If Chapter 7 is out of the question, then maybe Chapter 13 is the right answer. You’ll never know for sure unless you get answers from a Mount Vernon bankruptcy attorney.