I am an estate planner, so I am following the multitude of tax reform proposals that have been flowing from politicians through the campaign and election season, and especially now as the Trump Tax Plan rolls out. There may be reason to worry about the individual tax rates and the brackets. However, what happens to the federal estate and gift tax does not keep me up at night. These taxes only affect a few of my prospective clients; the federal version of these taxes do not currently kick in until a taxpayer has assets in excess of $5.5M for a single person, or $11M for a married couple.

I am an estate planner, so I am following the multitude of tax reform proposals that have been flowing from politicians through the campaign and election season, and especially now as the Trump Tax Plan rolls out. There may be reason to worry about the individual tax rates and the brackets. However, what happens to the federal estate and gift tax does not keep me up at night. These taxes only affect a few of my prospective clients; the federal version of these taxes do not currently kick in until a taxpayer has assets in excess of $5.5M for a single person, or $11M for a married couple.

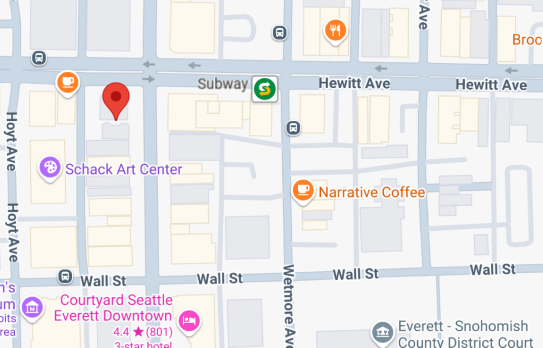

What affects a larger number of my prospective clients is the Washington State estate tax. This kicks in at a much lower level, around $2.15M of assets for a single taxpayer. The Washington State estate tax, one of the highest estate taxes in the country, is the tax that drives the bulk of my estate planning for tax purposes in Washington. So the outcome of the estate tax debate in Washington D.C. is interesting to me, but it is not going to change my business all that much. The Washington State estate tax is not tied to the federal estate tax, so it is unlikely to change based on the outcome in Washington D.C..

Be Cautious

However, there are many people that are uncertain as to what to do right now since there is bound to be some change in the tax regimes in force in the coming year. I am happy to meet with clients or prospective clients to discuss your particular situation. Generally, this is probably not the time to be creating a bunch of irrevocable trusts for federal estate tax reasons. Better to cautiously wait if time allows. Be aware that very few people fall into the federal estate tax so it is unlikely that you need to worry too much about whether there is a federal estate tax or not.

Another caution I will leave you with. While the Trump Tax Plan proposes to repeal the federal estate tax, this is a separate tax from the federal gift tax. None of the proposals thus far have proposed repealing the federal gift tax. We don’t know how the federal gift tax will change as a result of any future tax reform, but it is unlikely to go away. Again, the current tax policy is that gift taxes are due when total lifetime gifts exceed the $5.5M for an individual, and $11M for a married couple. It is no coincidence that the trigger levels of this tax are the same as the estate tax; they share the same “unified credit.” If the estate tax were to be repealed, there would need to be some legislative work done on the gift tax. More specifically, the unified credit would need to be revised to carve the gift tax out of it, and specify the tax-free gifting maximum amount.

There is no Washington State gift tax.

Let’s talk….

Please schedule a consultation with me if you are worried about the Trump Tax Plan or the estate tax from either the state or the federal variety. I am happy to discuss and help you plan for the future, and maximize your financial well-being going forward.