Let’s face it. It happens.

Divorce. It’s not pleasant, but sometimes it’s necessary. Today I’ll talk a little about the intersection of divorce with bankruptcy law. I don’t do divorce work, but I seem to get pulled into the topic frequently. As a bankruptcy attorney, this area of the law seems to come up all the time and I am seeing more and more folks come to me regarding divorce and bankruptcy – so, I thought that would make a good topic for today’s blog.

The biggest question is – Should I seek bankruptcy before getting divorced?

This is a tough question and it really can’t be answered without sitting down with you to understand all of the facets of the situation. But there are a few things to note about making the decision.

If you are in an active divorce case, filing bankruptcy will not usually stop the proceedings altogether; the automatic stay doesn’t apply. But, it would apply to the separation or division of property – this part of the proceedings may be put on hold until the end of the bankruptcy case.

If you file while married, you can possibly file a joint case and save yourself some money

- Issues like conflict of interest can come into play

- Really depends on how well you are getting along with your spouse

- Also, the bankruptcy chapter chosen / qualified for would impact the decision

What if I get a divorce and then seek a bankruptcy

First and foremost – domestic support obligations are not dischargeable.

Be aware that most joint debts that are your responsibility to pay by order of the divorce decree are generally not dischargeable in a Chapter 7 case. I see this issue all the time. If you are in this situation, you may be looking at a Chapter 13.

What is Marital / Community property and what is Separate property?

This is again a complex question, and involves much analysis to get to the answer. It comes up more often when couples are still married – that is because the state court has not yet determined the character of your property.

Here in Washington state, it is a little more cut and dried: The general rule is that if you acquired something during the marriage, then it is community property. The debt you take on to buy that item is also community debt. This is the assumption – it can be changed if there is an exception or some other compelling reason why it isn’t. But, without more, courts in Washington will generally hold that it is community in nature.

Wrap-up

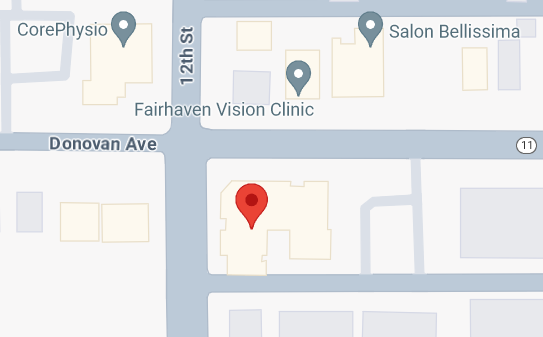

I’ll stop there as I don’t want to get too much into the weeds. I will end by saying that this is one of the most difficult and complex areas of bankruptcy and you don’t want to be taking this on yourself. Seek a knowledgeable bankruptcy attorney here in Mount Vernon or in Everett or, if you’re in Washington State – call for an initial consultation.

I hope this was helpful. I’d love to talk to you about your specific situation.

If you think this might be helpful to others you know, please forward it to them.