At Westward Law pllc, we are committed to looking hard at every debt that you have to see if it can be discharged as part of a possible bankruptcy petition. Student loans present difficult and complex questions for a bankruptcy attorney and prospective clients.

The Purpose Behind the strict treatment of Student Loan Debt

Congress updated the Bankruptcy Code in 1978 to prevent the abuse of the student loan programs, “in response to the perception that a growing tide of students were abusing the bankruptcy laws by discharging large amounts of educational indebtedness shortly after leaving school, despite having well-paying jobs and few other debts.” George H. Singer, Section 523 of the Bankruptcy Code: The Fundamentals of Nondischargeability in Consumer Bankruptcy, 71 Am. Bankr. L.J. 325, 387 (1997).

How is Student Loan Debt Evaluated?

Thus, Sec. 523(a)(8) was created to limit the availability of discharge of student loans to only those borrowers that are faced with an “undue hardship” in paying back the loans. Inconveniently, Congress did not provide a definition for what “undue hardship” means. This leaves bankruptcy lawyers to craft arguments about the unique circumstances that our clients are faced with each time we try to have these debts discharged.

The Test

In 1987, the bankruptcy court set out a three-part test that attempts to simplify the process of evaluating whether student loan debt should be discharged. Brunner v. New York Higher Education Services Corp., 831 F.2d 395 (2d Cir. 1987). The Brunner Test, as it has become known since its creation in the case of the same name, sets out three specific elements that must be satisfied before educational debt can be discharged:

- based on current income and expenses, the debtor cannot maintain a minimal standard of living for herself and her dependents if she has to repay the loan;

- additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the loan repayment period; and

- the debtor has made a good faith effort to repay the loan.

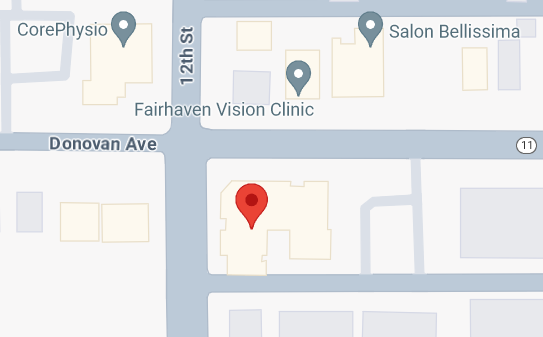

Westward LAW pllc will take a look at your specific situation to evaluate your likelihood of satisfying this test. If you have a shot, we can make the argument for you. Call us today at (360) 899-5468.

Find out more about bankruptcy