Many of my clients have IRAs, with large accumulated balances from a lifetime of earning and careful investment. We all want to make sure that this integral part of our estates are available for us in our retirement no matter how long that might be, and we want it to be preserved for the future use of our family when we are gone. Fortunately (and unfortunately), our government has thought of this and there are myriad rules that govern how we are to take money out of our IRAs. IRA Minimum Distribution Rules are important to both of these goals.

One of the key concepts to understand when we talk about IRAs is that, most of the time, we are talking about income that has not yet been taxed (this is the case in a traditional IRA). The taxing authorities have allowed this deferral of taxes so that our money set aside for retirement can grow even faster (since the amounts invested were not reduced by the appropriate tax back when the income was earned). This is nice of them to allow this deferral; however, they know that they’ll eventually get their money. And when they do, the taxable amount will have grown substantially. But, they do not want the deferral to last too long. They do eventually want their money. This is why we have the “minimum required distribution” rules.

Under the IRA minimum distribution rules, we must generally begin to withdraw our money from the IRA when we reach 70.5 years of age. The money we are required to withdraw is considered income because it never was taxed in the first place; we then have to pay an income tax (at the appropriate variable rate) on this withdrawal.

Then, every year after that, the amount is recalculated based on a life-expectancy table and the amount of the minimum distribution will change. This annual recalculation is done so that there will be some amount of the IRA left throughout our years of retirement, even if it lasts for 20 or 30 years.

This is all fairly straight-forward. It is after we die that the rules can be complicated. Also, some of the complication after our death could in many cases been avoided by some careful estate planning. If you do things right, your family members should be able to withdraw your IRA money in small annual amounts for the rest of their lives. This allows all of the hard work you put in to setting aside this money to really go to work for your loved ones you’ve left behind. The more years that your IRA investment is allowed to grow inside of the IRA without being disturbed, the more investment return and capital accumulation that can take place before the taxation finally occurs. Done wrong, you family member may be limited to having to withdraw all of the money in your IRA (and then pay tax on it) in just a few years instead of stretching it out for many, many years.

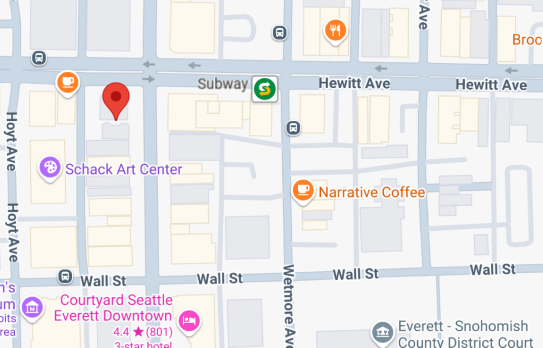

Schedule a time to chat with a Mount Vernon or Everett Estate Planning Attorney to discuss your options regarding your IRA.