Figuring Out Income

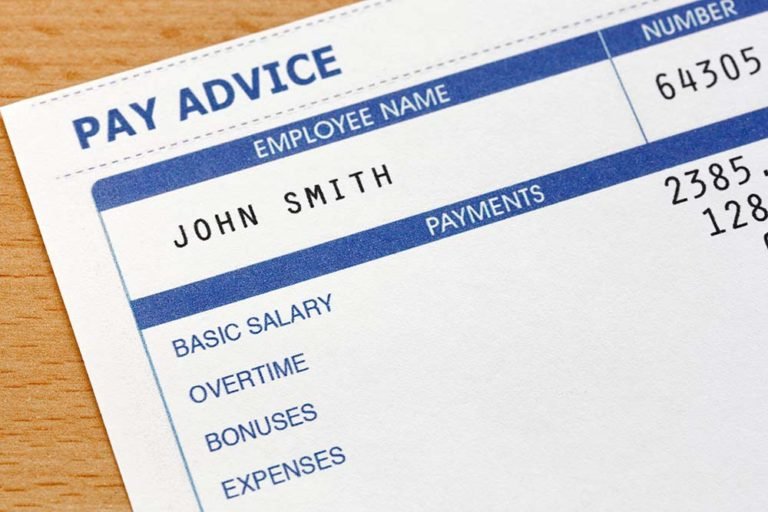

In Bankruptcy, nearly everything that comes in the door is part of monthly income. Even non-taxable income is generally counted as income in bankruptcy (at least in some instances).

You see, income can be different depending on what you are figuring out. In the means test, you are allowed to keep Social Security out of the picture; but, as soon as you move over to filling out Schedule I, you need to have it in there. Therefore, there is no easy answer to what one should count as income. In my conclusion below – you guessed it – I refer you to a bankruptcy attorney for definitive answers.

Is it a Gift or Income?

If you receive a gift of money from your parents every once and a while, this is probably not considered income. You may need a little money to make ends meet from time to time, and your family and friends are happy to lend a hand. As long as this money comes in relatively infrequently and not on a regular schedule, it is likely to be considered a gift and not income. However, if you are seeing a check from Dad every month for $300 so you can pay your rent, this could be considered income. These types of categorizations can be tricky and is one of those areas where I mention that you ought to see an Everett bankruptcy lawyer about this.

Child Support

Another tricky area of income is whether or not to consider child support income. It usually comes in on a regular basis (at least it is supposed to). Should this be considered income? It is definitely used to support the family, buy groceries, etc. Because of this, it should be considered income on Schedule I just like Social Security was. Similarly to Social Security, this type of income does not need to be counted as income when you are administering the Means Test.

Current Monthly Income (CMI)

So, how do we figure out your monthly income? In Chapter 7, there is a form called “Chapter 7 Current Monthly Income,” otherwise known as “CMI.” To figure out CMI, you must take all income from the past 6 full months and then average them. This is what you will generally be using as the income figure in your Chapter 7 bankruptcy. It is good to point out the simple rules at play in an average number. First, if

your income has been increasing over the past six months you are going to have a larger number as time goes on. If this is important in the bankruptcy figures, you may need to file your case quickly to keep the income from going up any further. Secondly, the opposite is true. If your income has been going down over the past six months and you expect this to continue, you may want to wait a little while to file your case as this may result in a lower income figure.

Importance of Income

Income is very important in Bankruptcy – especially in a Chapter 7. Income can mean that you are not qualified to file a Chapter 7 bankruptcy if it is too high. Therefore, it is wise to be careful and thorough when figuring out income. It could mean the difference between getting a discharge of your debt, or not. It all depends on your specific situation, so you may want to see a Mount Vernon bankruptcy attorney about that.