I am now fully expecting to see a pronounced uptick in bankruptcy filings as the effects of this coronavirus and bankruptcy play out. It may take a few weeks to become evident, but the uptick will be there. How large of a spike will we see?

Whenever the economy struggles for several weeks or more we’ll generally see the number of phone calls and, eventually, bankruptcy filings go up. When people start losing their jobs, then we immediately face increased demand for our bankruptcy services. While I hope this does not happen, we’re here to help if it does. I’ve already had several inquiries from people that have lost their job temporarily. We’ll see how long that lasts. Consumers generally do not have much of a financial buffer. If unemployment lasts for more than a month or two, people will begin thinking about other avenues for relief. As soon as people are losing jobs permanently, we’re going to seen more case.

It remains to be seen how forgiving creditors will be in this environment. They would be wise to give their customers some time to make things right. If they start jacking up interest rates and tacking on big late fees, then the borrowers will revolt. When people look at interest rates of 26% on a credit card bill, they will often begin thinking about ways to avoid paying the creditor these unreasonable interest rates. That’s when they come see me.

My hope is that this economic debacle turns into a blip. I don’t want to see folks losing jobs and worrying about the future. But, that’s where we are today. Coronavirus and bankruptcy will be “joined at the hip,” as they say. The longer this goes on, the more bankruptcy cases we’ll see.

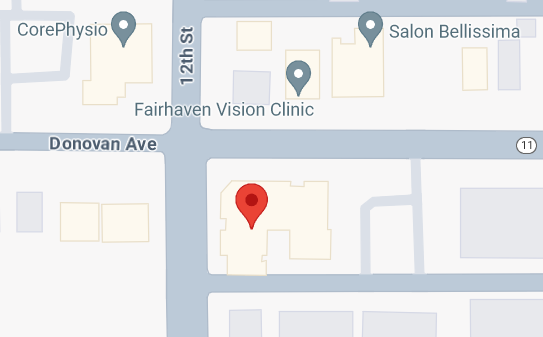

To schedule time with a bankruptcy attorney, follow the link: –> Initial Consult Scheduler