The Automatic Stay

The automatic stay is one or the most powerful aspects of bankruptcy for the person that finds himself in deep financial trouble. If creditors are calling you non-stop, filling your mailbox with official sounding letters, or even if you have been served with papers requiring your appearance in court, the automatic stay can stop all of it in its tracks. The automatic stay will generally go into effect instantly upon the filing of a bankruptcy petition.

Th automatic stay is based on federal statute, and is set out in Sec. 362 of the Bankruptcy Code. This section is long and complex. However, one of the most straight forward subsections can be found in 362(a)(6), which prohibits “any act to collect, assess, or recover a claim against a debtor that arose before the commencement of the case.”

The automatic stay is an order of the bankruptcy court, and it carries the power of a federal court order. All creditors must cease any collection activity immediately. Creditors can find themselves is very hot water with the court if they do not comply with the automatic stay. Creditors cannot even continue collection efforts that don’t involve the debtor directly, like the process of recording or “perfecting” a loan or mortgage. If the creditor did not do something that they should have before the automatic stay takes effect, they can be left in a much weaker and less protected position.

The intent of the automatic stay is to allow the “debtor” the space and time to think about their situation and make plans to emerge from it without creditors calling every five minutes. It is much easier (and less stressful) to have peace and quiet while you are trying to get your arms around the situation. That is why bankruptcy in general, and the automatic stay more specifically, is a powerful tool for consumer debt relief. It provides relief from debt collection activities that are unfair to other creditors, and complicate a debtor’s path forward.

Creditors’ relief from the Automatic Stay

While the automatic stay is a very, very powerful weapon that your bankruptcy attorney will use to protect you from your creditors, there are also ways that creditors can get the automatic stay “lifted” by making a motion in the bankruptcy court. The judge must approve the motion for relief from the stay, and they will generally only do so for a short list of very specific reasons. Here are some of the reasons why the automatic stay could be lifted:

- Automatic termination: This can come into play when a debtor has filed a second bankruptcy case in less than a year. This provision is intended to prevent abuse of the bankruptcy system that prevents a creditor from enforcing the creditor’s rights (like foreclosure on a house).

- By creditor request: usually requested by secured creditors that argue that collateral securing the loan is degrading, and their interest in the collateral is not adequately protected.

- Failure to file a Statement of Intention: A debtor that overlooks the requirement to file a statement of intention regarding a secured asset within the proscribed time frame could see the automatic stay lifted for that particular secured asset. This statement tells the court, trustee, and the creditor whether you intend to retain or surrender the particular secured asset.

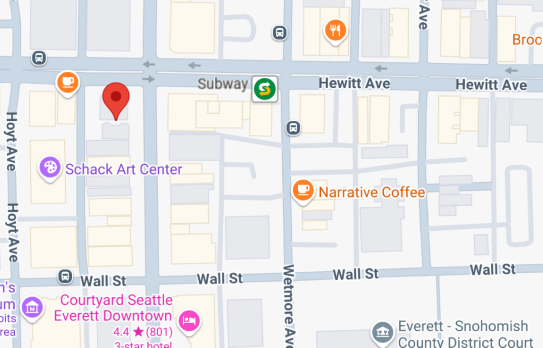

See an Everett, Mount Vernon, or Bellingham bankruptcy attorney if you are thinking about bankruptcy, or are in need of relief from aggressive bill collectors.

At Westward LAW, we pride ourselves on helping clients in financial difficulty and providing relief from creditors. Call us today at (360) 899-5468